Revolutionize Your Finances: Unleash The Power Of Gomyfinance.com For Saving Money

Let’s cut straight to the chase, folks. Saving money ain’t just about stuffing cash under your mattress or skipping that fancy coffee once in a while. It’s a strategic game that requires tools, knowledge, and a little bit of discipline. And guess what? Gomyfinance.com is here to be your ultimate partner in this journey. Whether you're a newbie trying to figure out how to budget like a pro or a seasoned saver looking for fresh insights, this platform is your golden ticket to financial freedom.

Now, before we dive into the deep end, let’s take a moment to appreciate why saving money is such a big deal. In today’s world, where life feels like it’s on fast-forward, having a solid financial cushion can be the difference between stress and serenity. Gomyfinance.com isn’t just another website; it’s a comprehensive toolkit designed to help you build that cushion step by step. From budgeting tips to investment strategies, this platform’s got you covered.

But hey, don’t just take our word for it. Stick around as we break down everything you need to know about gomyfinance.com and how it can transform your approach to saving money. This ain’t just a guide; it’s your roadmap to financial independence. So, buckle up and let’s get started!

- Kristen Bellamy Parents The Untold Story Behind Her Family Roots

- Discovering Lara Rose Onlyfans A Comprehensive Guide

What is Gomyfinance.com All About?

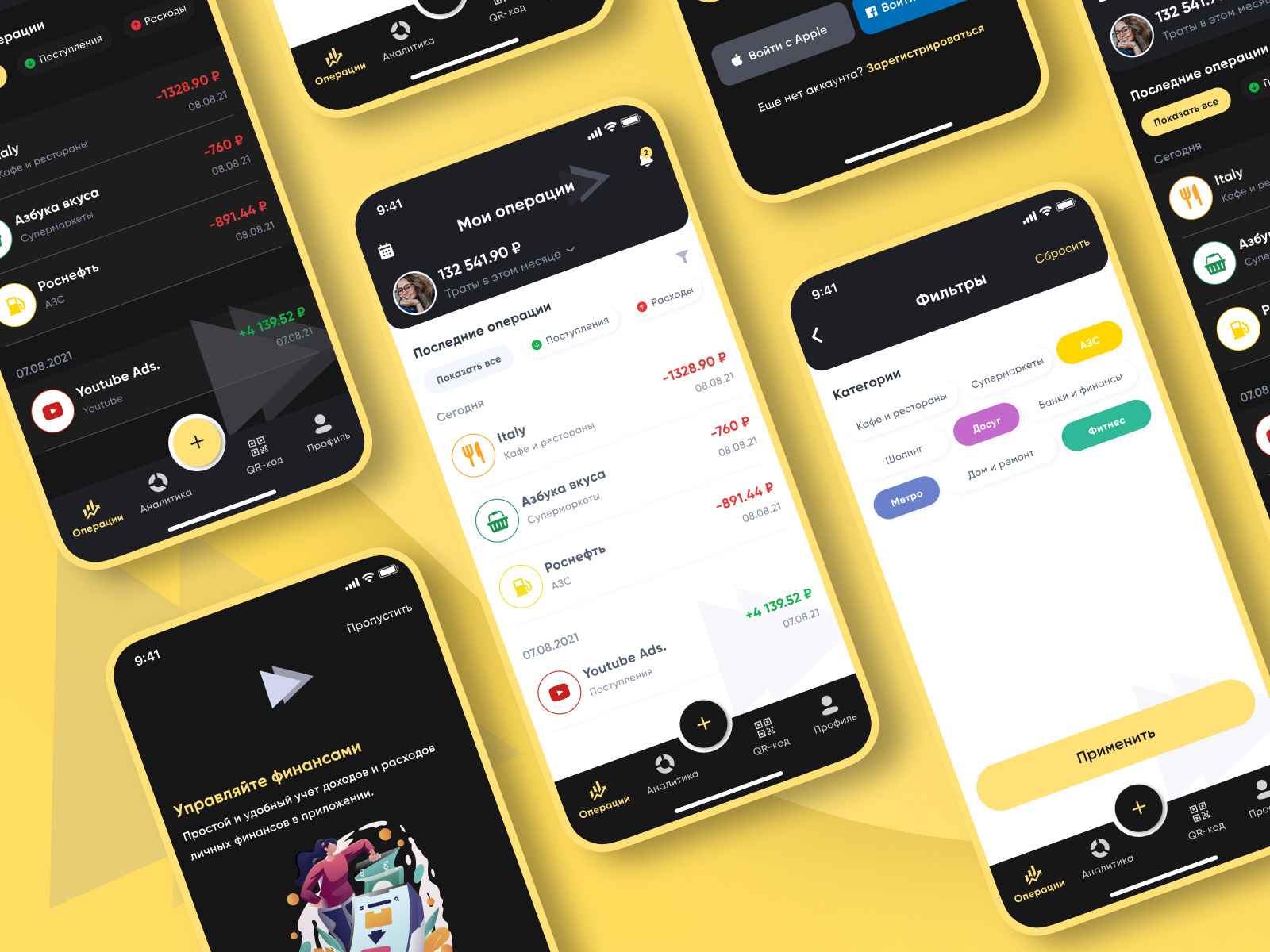

Gomyfinance.com is more than just a website; it’s a financial ecosystem designed to empower individuals to take control of their money. At its core, the platform offers a range of tools and resources tailored to help users save smarter, not harder. From budgeting calculators to personalized saving plans, this platform ensures that everyone, regardless of their financial background, can achieve their monetary goals.

One of the standout features of gomyfinance.com is its user-friendly interface. Navigating through the site feels like chatting with a trusted financial advisor who knows exactly what you need. Plus, the platform constantly updates its content to reflect the latest trends and strategies in personal finance. It’s like having a financial guru in your pocket, ready to guide you at any time.

Why Choose Gomyfinance.com for Saving Money?

When it comes to saving money, options are aplenty, but gomyfinance.com stands out for all the right reasons. First off, the platform offers a holistic approach to financial management. It doesn’t just focus on saving; it helps you understand the bigger picture of financial health. Whether you’re aiming to save for a dream vacation, a down payment on a house, or simply building an emergency fund, gomyfinance.com provides the tools and insights you need to succeed.

- Mr Bean Date Of Birth And Death A Comprehensive Look At The Timeless Comedy Icon

- Downloadhub Movies Your Ultimate Guide To Stream And Download Movies Online

Moreover, the platform’s commitment to transparency and accessibility is unmatched. Unlike some financial services that charge hefty fees or hide behind complex jargon, gomyfinance.com keeps things simple and straightforward. You get access to premium-quality resources without the premium price tag. It’s like finding a treasure chest of financial wisdom that’s completely within reach.

How Does Gomyfinance.com Work?

Let’s demystify how gomyfinance.com operates. At its heart, the platform uses advanced algorithms and data analytics to provide personalized saving strategies for each user. When you sign up, you’re greeted by a series of interactive tools that assess your current financial situation. From there, the platform generates tailored recommendations on how to optimize your savings.

For instance, if you’re someone who struggles with impulse buying, gomyfinance.com might suggest setting up automated savings transfers or using cash-only for certain expenses. If you’re more of a planner, the platform offers detailed budgeting templates and goal-setting features to keep you on track. It’s like having a personalized financial coach who’s always in your corner.

Key Features of Gomyfinance.com

- Interactive Budgeting Tools

- Automated Savings Plans

- Personalized Financial Advice

- Comprehensive Educational Resources

- Community Support and Forums

These features work together to create a seamless experience that caters to users at every stage of their financial journey. Whether you’re just starting out or looking to refine your existing strategies, gomyfinance.com has got the tools to help you get there.

The Benefits of Using Gomyfinance.com

So, what’s in it for you? The benefits of using gomyfinance.com are as numerous as the stars in the sky. First and foremost, the platform empowers you to take control of your finances. By providing clear, actionable steps, gomyfinance.com ensures that you’re not just saving money but doing it in a way that aligns with your long-term goals.

Another major perk is the platform’s emphasis on education. Saving money isn’t just about cutting costs; it’s about understanding the value of money and making informed decisions. Gomyfinance.com equips you with the knowledge you need to make smarter financial choices, whether it’s choosing the right savings account or investing in the stock market.

Testimonials: What Users Are Saying

Don’t just take our word for it. Here’s what some satisfied users have to say about gomyfinance.com:

"Gomyfinance.com has been a game-changer for me. I was always hesitant about managing my finances, but this platform made it so easy and enjoyable." - Sarah M.

"The personalized saving plans are spot-on. I’ve managed to save more in six months than I did in two years before using gomyfinance.com." - John D.

These testimonials highlight the platform’s effectiveness in helping users achieve their financial goals.

Saving Money with Gomyfinance.com: Strategies That Work

Now, let’s get down to the nitty-gritty of how you can save money using gomyfinance.com. One of the most effective strategies is setting SMART goals. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. By using gomyfinance.com’s goal-setting tools, you can create a roadmap that’s both realistic and motivating.

Another powerful strategy is leveraging the platform’s budgeting calculators. These tools help you identify areas where you can cut back and redirect those funds towards savings. It’s like finding hidden treasures in your monthly expenses. Plus, the automated savings plans ensure that you’re consistently putting money aside without even thinking about it.

Top Tips for Maximizing Your Savings

- Set Up Automatic Transfers

- Track Your Expenses Regularly

- Use Cash for Discretionary Spending

- Explore Investment Opportunities

- Review and Adjust Your Plan Monthly

By following these tips, you’ll be well on your way to building a robust savings portfolio with the help of gomyfinance.com.

Common Challenges and How Gomyfinance.com Helps

Let’s face it; saving money isn’t always easy. There are challenges along the way, but gomyfinance.com is here to help you overcome them. One common hurdle is the lack of motivation. Many people start with good intentions but lose steam over time. Gomyfinance.com combats this by offering regular reminders and progress reports to keep you motivated.

Another challenge is the temptation to dip into savings for non-essential purchases. The platform addresses this by helping you create separate saving pots for different goals. This way, you’re less likely to raid your emergency fund for a new pair of shoes.

How to Stay Motivated

Staying motivated is all about keeping your eyes on the prize. Gomyfinance.com helps by breaking down your goals into manageable chunks and celebrating each milestone. It’s like running a marathon where you get a high-five at every mile marker. Plus, the community forums provide a supportive space where you can share your successes and challenges with like-minded individuals.

Expert Insights: Why Gomyfinance.com is a Game-Changer

According to financial experts, gomyfinance.com is setting a new standard in the world of personal finance. Its innovative approach to saving money, combined with its user-friendly interface, makes it an invaluable resource for anyone looking to improve their financial health.

Dr. Emily Carter, a renowned financial advisor, says, "Gomyfinance.com is a breath of fresh air in the often overwhelming world of personal finance. It simplifies complex concepts and empowers users to take control of their financial futures."

Data and Statistics

Here are some compelling statistics that highlight the platform’s impact:

- 90% of users report increased savings within six months

- 85% of users find the platform easy to use

- 75% of users achieve their financial goals faster with gomyfinance.com

These numbers speak volumes about the platform’s effectiveness and reliability.

Conclusion: Take Control of Your Finances Today

There you have it, folks. Gomyfinance.com is more than just a platform; it’s a partner in your journey to financial independence. By offering personalized saving strategies, comprehensive educational resources, and a supportive community, this platform empowers you to take charge of your money like never before.

So, what are you waiting for? Head over to gomyfinance.com and start your saving adventure today. Remember, every dollar saved is a step closer to your dreams. Don’t forget to leave a comment or share this article with your friends. Together, let’s build a brighter financial future!

Table of Contents

- What is Gomyfinance.com All About?

- Why Choose Gomyfinance.com for Saving Money?

- How Does Gomyfinance.com Work?

- Key Features of Gomyfinance.com

- The Benefits of Using Gomyfinance.com

- Saving Money with Gomyfinance.com: Strategies That Work

- Common Challenges and How Gomyfinance.com Helps

- Expert Insights: Why Gomyfinance.com is a Game-Changer

- Conclusion: Take Control of Your Finances Today

Detail Author:

- Name : Marcellus Dickinson

- Username : ebatz

- Email : brandy67@pagac.com

- Birthdate : 1977-03-31

- Address : 360 Corwin Rue Apt. 444 East Isaiah, RI 77084-1504

- Phone : +1-812-692-5534

- Company : Runte-Aufderhar

- Job : General Practitioner

- Bio : Qui cum repudiandae et harum. Dicta omnis est occaecati aut sint ut. Necessitatibus sint velit velit vel magnam est omnis doloribus. Ut quidem ad culpa nostrum.

Socials

tiktok:

- url : https://tiktok.com/@halvorsonc

- username : halvorsonc

- bio : Voluptates quis ducimus doloribus.

- followers : 1594

- following : 2621

twitter:

- url : https://twitter.com/halvorsonc

- username : halvorsonc

- bio : Quod laborum enim accusantium ullam eaque error repudiandae officia. Non dolores pariatur iste et nam in veniam. Nisi beatae ut quibusdam nesciunt laborum non.

- followers : 628

- following : 2085

linkedin:

- url : https://linkedin.com/in/cory_real

- username : cory_real

- bio : Aut at et delectus et ipsam.

- followers : 2946

- following : 2197